Financial Literacy for Teens: Building Strong Financial Foundations Early

Introduction: Why Financial Literacy is Crucial for Teens

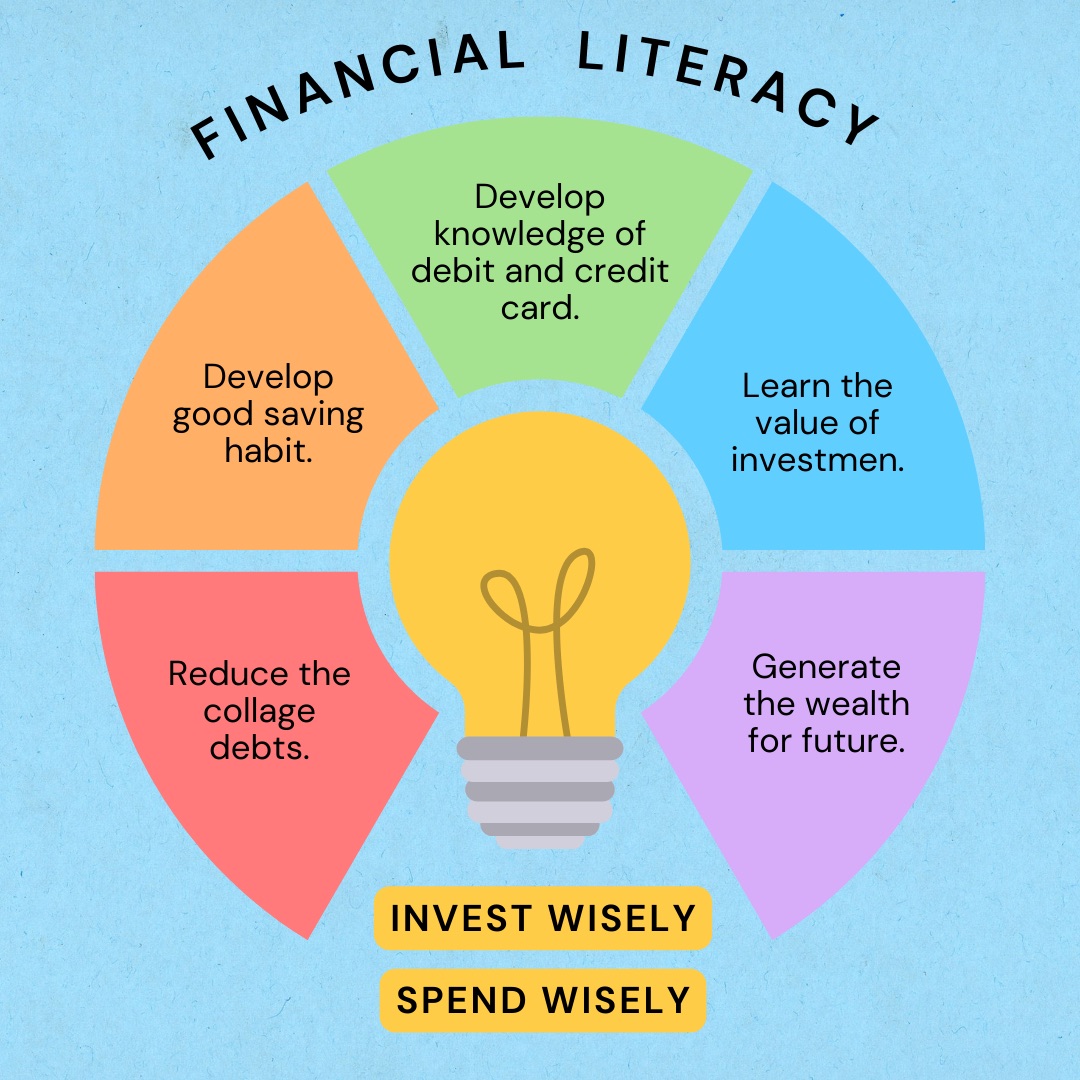

Financial literacy is an essential skill that every teen should learn. It empowers young people to manage money effectively, make informed decisions, and avoid common financial pitfalls. In a world where financial challenges are prevalent, understanding concepts like budgeting, saving, and investing can set teens up for long-term success.

1. The Importance of Financial Literacy for Teens

1.1 Preparing for Independent Living

As teens grow older, they start becoming more independent. Learning how to manage finances is a critical part of this transition. Financial literacy helps teens prepare for adult responsibilities like paying bills, budgeting, and saving for the future. Without this knowledge, they may struggle when faced with these challenges.

1.2 Avoiding Debt and Financial Struggles

Debt is a major issue for many young adults, and teens who understand how to manage their finances are less likely to fall into financial traps. By learning about budgeting and saving early, they can avoid common mistakes like overspending or accumulating credit card debt.

1.3 Empowering Teens to Make Smart Financial Choices

Financial literacy allows teens to make better decisions about spending, saving, and investing. It helps them understand the impact of their financial choices and empowers them to make informed decisions that align with their goals. Whether it’s choosing a college, buying a car, or investing in the stock market, being financially literate gives them the tools they need to succeed.

2. Key Financial Concepts Every Teen Should Know

2.1 Budgeting: The Foundation of Financial Success

One of the first steps in financial literacy is learning how to create and follow a budget. Teens should be taught how to track their income (allowance, part-time job earnings, etc.) and expenses (e.g., food, entertainment, transportation). Budgeting helps them prioritize needs over wants and avoid impulse spending.

-

Track income and expenses: Writing down or using apps to track spending can help teens see where their money is going.

-

Set financial goals: Whether it’s saving for a concert or a bigger purchase, having goals keeps teens motivated and focused on managing their money.

-

Create a simple budget: A basic budget should include categories for savings, essentials, and non-essentials.

2.2 Saving: Building a Safety Net

Teaching teens to save money is crucial for their financial well-being. A savings plan can help them prepare for unexpected expenses and future goals. Encourage teens to set aside a portion of their earnings for savings before spending on discretionary items.

-

Create a savings account: Teens should have a dedicated account where they can deposit their savings.

-

Emergency fund: Having a savings cushion helps them deal with emergencies without relying on credit cards or loans.

-

Long-term goals: Teens should understand the importance of saving for larger goals like education or buying a car.

2.3 Credit and Debt: Understanding the Risks

Understanding how credit works is an essential part of financial literacy. Teens should learn how to responsibly use credit cards, loans, and avoid falling into debt. They should also understand the impact of credit scores on future borrowing and what steps they can take to build good credit.

-

Credit cards: Explain how credit cards work, the risks of debt, and how interest rates can affect the total cost of purchases.

-

Debt management: Discuss strategies for avoiding debt, like paying off balances in full and on time.

-

Credit scores: Teach teens about credit scores and how maintaining a good score will help them in the future.

3. Tools and Resources to Help Teens Learn Financial Literacy

3.1 Online Courses and Websites

There are many free resources available online that teach teens about financial literacy. Websites like Khan Academy and NerdWallet offer valuable lessons and tools for teens to learn at their own pace. These platforms cover a range of topics from budgeting to investing and can be a great starting point for young learners.

3.2 Apps for Managing Money

Many apps are designed specifically to help teens manage their money. Apps like Mint, You Need a Budget (YNAB), and GoodBudget allow teens to track their spending, set savings goals, and learn about budgeting. These tools make it easy for teens to develop good financial habits.

3.3 Books and Resources for Teens

Books specifically tailored for young people can provide additional guidance. Titles like “The Teen Investor” by Emmanuel Modu and “Money Sense for Kids” by Hollis Page Harman are excellent resources for teaching financial literacy in a fun, relatable way. These books break down complex topics into simple, easy-to-understand lessons.

4. Financial Literacy Programs for Teens

4.1 School Programs and Clubs

Many schools now offer financial literacy programs as part of their curriculum. If your teen’s school does not offer such programs, consider looking into local financial literacy clubs or workshops. These programs often provide hands-on experience and teach practical skills that teens can apply in their everyday lives.

4.2 Workshops and Seminars

Local community centers, libraries, and even banks often host workshops or seminars on financial literacy. These events can be a great way for teens to interact with financial professionals and get expert advice on managing money.

5. The Role of Parents in Teaching Financial Literacy

5.1 Setting a Good Example

Parents play a critical role in teaching financial literacy to their children. By modeling good financial habits, such as saving, budgeting, and paying bills on time, parents can demonstrate the importance of responsible money management. Teens often learn by example, so showing them how to manage money effectively is one of the best lessons you can provide.

5.2 Open Conversations About Money

It’s essential to create an open and honest dialogue about money within the family. Discuss topics like budgeting, saving, and investing with your teen. Encourage them to ask questions and provide answers that are age-appropriate and relatable.

5.3 Giving Teens Financial Responsibility

Allowing teens to manage their money and make decisions about spending, saving, and investing will help them develop confidence in their financial skills. Consider giving them a small allowance or letting them handle their own expenses, with guidance when necessary.

6. Frequently Asked Questions About Financial Literacy for Teens

Q1: At what age should my teen start learning about finances?

A1: The earlier, the better! Even teens as young as 12 can begin learning basic financial concepts like budgeting and saving. Starting early helps them develop good habits that will last a lifetime.

Q2: How can I encourage my teen to learn about money?

A2: Encourage your teen by making financial literacy fun and engaging. Use apps, games, and real-life examples to show them how managing money can be rewarding. Start small and build on their knowledge as they grow.

Q3: What should my teen know about credit?

A3: Teens should understand how credit works, the importance of a good credit score, and how to use credit responsibly. Teaching them about credit cards, loans, and the consequences of overspending can help them avoid debt in the future.

Q4: Are there any online tools for teaching my teen about investing?

A4: Yes! There are several tools and resources, like Investopedia and Robinhood, that can help teens learn about investing. These platforms offer beginner-friendly guides and simulations to help them understand how the stock market works.

Conclusion: Empowering Teens for a Financially Secure Future

Financial literacy is an essential skill for teens to learn as they prepare for adulthood. By teaching them about budgeting, saving, credit, and investing, we equip them with the tools they need to make smart financial decisions. With the right resources and guidance, teens can build a strong financial foundation that will serve them well throughout their lives.

By starting early and continuing the conversation about money, we can help the next generation become financially responsible and confident adults.